The BC Liberals are pressuring the provincial government to take action that would result in small businesses seeing lower property tax bills on "unused airspace" above a building – something the opposition calls a "tax on air."

Several businesses, municipalities and organizations have raised the alarm over skyrocketing property tax bills. As land value increases at a fast pace, businesses are being billed for the potential use of that property. As an example, a one-story business that had the potential to build up would be taxed on the space above the building. Commercial property tax rates are also typically higher than residential rates.

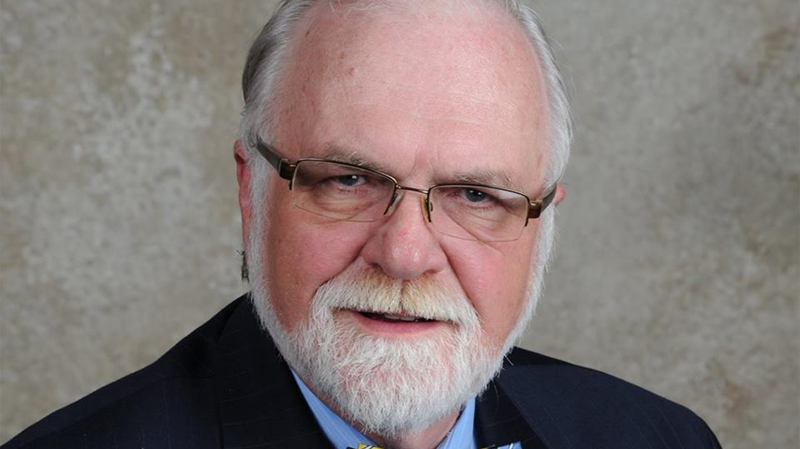

"This is a tool that the City of Vancouver and a good number of other Metro Vancouver municipalities are asking for the province to provide them," said Stone about a bill introduced in the legislature Wednesday.

The Assessment (Split Assessment Classification) Amendment Act, 2019, would allow cities to split the property tax assessments and charge a different amount for airspace. Stone, the MLA for Kamloops-South Thompson, said municipalities have to set these rates by the end of the month for the next tax year.

In some cases, the Liberals say, property tax bills have spiked 300 per cent over several years and accuse the government of failing to act quickly enough.

Private members' bills rarely become law.

Aaron Aerts with the Canadian Federation of Independent Business said a working group with several stakeholders – including senior government officials, BC Assessment and Metro Vancouver – recommended a similar solution.

Minister of Municipal Affairs and Housing, Selina Robinson, confirmed Wednesday the government is looking at solutions. Asked whether those would be in place for the 2020 tax year, she told CTV News the government had short-term and long-term measures in mind.

"This is not a new issue," she said. "That's being going on for some time. The previous government ignored it and we're going to provide some solutions."

Robinson didn’t provide any detail about what those measures could be.

The ministry also provided the following statement to CTV News.

"When this issue was raised at the recent UBCM Convention, many local governments gave compelling reasons why government shouldn’t immediately create a commercial sub-class without doing more work with communities from across B.C. Some of those communities pointed to the fact that local governments already have a number of tools available to address the impact of assessment increases. These include adjusting tax rates by assessment class, averaging the tax increases over a number of years, and providing full or partial municipal tax exemption for certain properties for up to 10 years."

Aerts thinks hundreds of small businesses are closing down or moving because of soaring tax bills, especially in places like Vancouver.