Metro Vancouver’s pricey real estate market is forcing many young buyers to pay a lot more for their first home – and many are turning to the bank of mom and dad for help, according to a new Real Estate Weekly study.

The study suggested that 75 per cent of first time buyers under the age of 30 expect some help from their parents for a down payment. Around 400 people took part in the study, which was released Sept. 11.

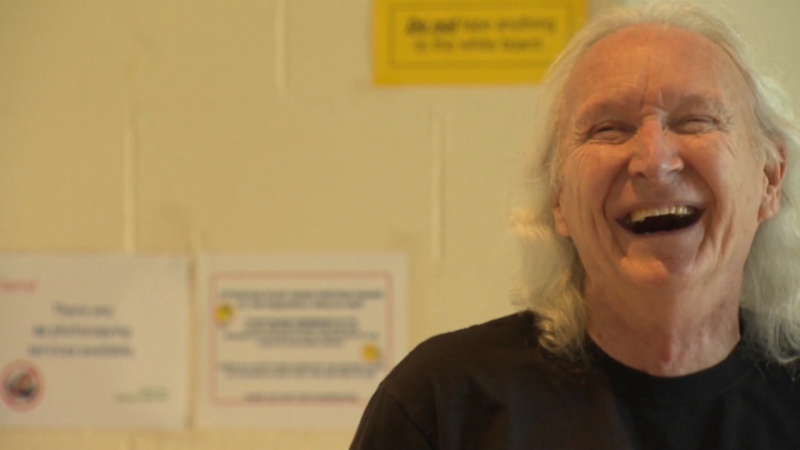

“We found a surprisingly large number of those respondents are really relying on the bank of mom and dad the help them with their down payments,” says Joannah Connolly, editor and content manager of Real Estate Weekly.

With the cost of a detached home averaging $1.5 million and rising, many parents are stepping in to help their adult children.

Vancouver realtor Colette Gerber has helped both her adult daughters, ages 26 and 31, with down payments for their homes.

“The problem with a lot of first time wannabee buyers is getting the money together for the down payment,” she says. “I believe the best way is to gift the down payment if you can because there’s no sense burdening your children with extra payments.”

The study also found that many young buyers expected to purchase homes beyond their means.

Most prospective buyers earned least than $70,000 but expected to buy homes worth $400,000 – and even that won’t get them an average priced condo in Greater Vancouver, now worth more than half a million dollars.

“What you’ve got is a baby boomer generation that has got a lot of wealth to share with their offspring,” adds Connolly. “A lot of inheritance is skipping a generation and going to young buyers too.”

Gerber says it makes sense for first time buyers to go to their parents – but she also have advice for those who don’t have that option.

“Be realistic in your expectations,” she says. “Don’t expect an absolutely up to date modern condo. Buy something you can afford and still have a little bit of money left...don’t spend it all.”

With files from CTV Vancouver’s Scott Roberts