Bank of Canada raises interest to 4.25%, highest since 2008

The Bank of Canada is pictured in Ottawa on Tuesday Sept. 6, 2022. THE CANADIAN PRESS/Sean Kilpatrick

The Bank of Canada is pictured in Ottawa on Tuesday Sept. 6, 2022. THE CANADIAN PRESS/Sean Kilpatrick

The Bank of Canada hiked its key interest rate by half a percentage point Wednesday to 4.25 per cent - the highest it's been since January 2008 - while signalling it may pause its aggressive rate hike cycle.

Since March, the central bank has raised its key interest rate seven consecutive times in an effort to bring inflation down and slow the economy.

“Looking ahead, 1/8 the 3/8 governing council will be considering whether the policy interest rate needs to rise further to bring supply and demand into balance and return inflation to target,” the Bank of Canada said in a news release.

That language is a marked departure from previous announcements where the bank said more rate hikes should be expected.

In note to clients, CIBC chief economist Avery Shenfeld said “the Bank of Canada flashed a yellow card on its rate hiking team.”

In its news release, the Bank of Canada said there's “growing evidence” that higher interest rates are restraining demand in the economy.

“Consumption moderated in the third quarter, and housing market activity continues to decline,” the central bank said.

The Bank of Canada said economic data released since its October interest rate decision supports its forecast that growth will stall through the end of the year and into the first half of 2023.

At the same time, it said inflation is still too high and short-term inflation expectations remain elevated.

In October, the annual inflation rate was 6.9 per cent, well above the Bank of Canada's two per cent target. However, economists have noted the three-month annualized inflation rate has dropped to below four per cent, suggesting inflation is headed in the right direction.

Forecasters were split on whether the Bank of Canada would opt for a quarter or half percentage point rate hike ahead of Wednesday's decision. Market watchers were also unsure if the central bank would continue raising interest rates in the new year.

CIBC expects the Bank of Canada to pause its rate hikes, but to keep its key rate elevated at 4.25 per cent until 2024.

“While the tightening cycle likely has reached its zenith, we'll need the pain of these higher rates to persist for a while to stall economic growth and thereby cool inflation,” said Shenfeld.

The Bank of Canada will announce its next interest rate decision on Jan. 25.

This report by The Canadian Press was first published Dec. 7, 2022.

CTVNews.ca Top Stories

Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

BUDGET 2024 Feds cutting 5,000 public service jobs, looking to turn underused buildings into housing

Five thousand public service jobs will be cut over the next four years, while underused federal office buildings, Canada Post properties and the National Defence Medical Centre in Ottawa could be turned into new housing units, as the federal government looks to find billions of dollars in savings and boost the country's housing portfolio.

Some of the winners and losers in the 2024 federal budget

With a variety of fiscal and policy measures announced in the federal budget, winners include small businesses and fintech companies while losers include the tobacco industry and Canadian pension funds.

From housing initiatives to a disability benefit, how the federal budget impacts you

From plans to boost new housing stock, encourage small businesses, and increase taxes on Canada’s top-earners, CTVNews.ca has sifted through the 416-page budget to find out what will make the biggest difference to your pocketbook.

Toronto police arrest several people at rail line protest

Several people have been arrested at a pro-Palestinian demonstration in the city’s west end that blocked rail lines for hours Tuesday.

500 Newfoundlanders wound up on the same cruise and it turned into a rocking kitchen party

A Celebrity Apex cruise to the Caribbean this month turned into a rocking Newfoundland kitchen party when hundreds of people from Canada's easternmost province happened to be booked on the same ship.

Teen hockey players arrested for sexual assault following hazing incident: Manitoba RCMP

Three teenagers were arrested in connection with a pair of alleged hazing incidents on a Manitoba hockey team, police say.

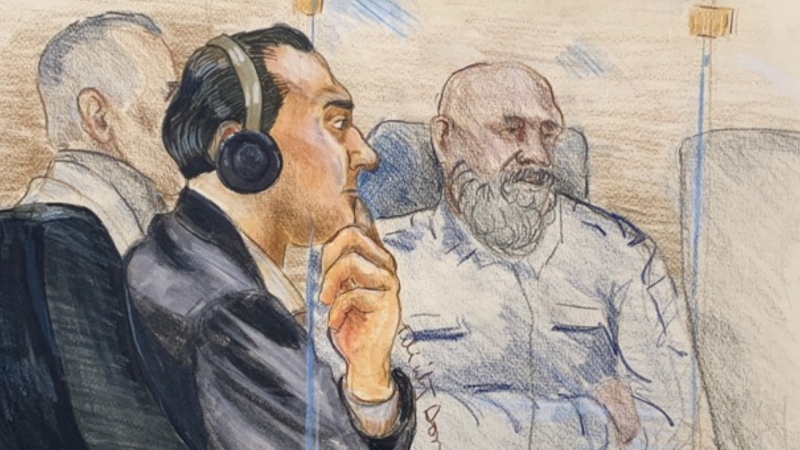

B.C. killer seeks to attend sentencing by video as lawyer cites safety concerns

A defence lawyer for Ibrahim Ali, who was convicted of first-degree murder of a 13-year-old girl in Burnaby, B.C., says the man wants to appear at his sentencing hearing by video over fear for his safety.

Lululemon unveils first summer kit for Canada's Olympic and Paralympic teams

Lululemon showed off its collection for the Summer Olympics and Paralympics on Tuesday at the Liberty Grand entertainment complex. Athletes sported a variety of selections during a fashion show that featured garments to be worn on the podium, during opening and closing ceremonies, media interviews and daily life on the ground in France.