B.C. woman can sue bank for allowing her to transfer $69K to fraudsters, appeal court rules

B.C.'s highest court has given new life to a fraud victim's case against her bank, which she alleges had a duty to warn her about scams that had been reported in the community before allowing her to transfer $69,000 overseas.

A B.C. Supreme Court judge had previously granted the bank's application to dismiss the case on the grounds that there was no reasonable prospect that the fraud victim – Li Zheng – would succeed in a trial.

The B.C. Court of Appeal disagreed, ordering the bank's application for summary judgment to be dismissed, and allowing the original case to proceed.

THE FRAUD

Writing for the appeal court's three-judge panel, Justice Susan Griffin summarized the facts alleged in Zheng's initial lawsuit.

"Ms. Zheng alleges that she received a phone call on May 15, 2018, from a person purporting to be with the Chinese consulate," the decision reads.

"The person had the number from her driver’s license, which was only one month old. The person told her that the international police were looking for her and that she was accused of being involved in an international money laundering case."

The fraudsters told Zheng that she would have to fly back to China to stay in jail during the investigation or transfer funds to Hong Kong, which would be returned to her after the investigation.

One week later, on May 22, Zheng went to a branch of the Bank of China (Canada) in Richmond and asked a teller to help her send $69,000 from her account to an account in someone else's name in one of the bank's branches in Hong Kong.

As part of the transfer process, Zheng signed an "application for remittance" that included an "exclusion-of-liability clause" releasing the bank from legal responsibility for problems arising from the transfer.

Zheng alleged that neither the teller nor another bank employee she spoke to asked her any questions about the transfer, though the bank's response to her claim indicated that internal control and compliance officer Bin Zhang asked about the relationship between Zheng and her intended recipient.

"(Zhang) deposed that he asked her this because it was an international transaction greater than $10,000, but Ms. Zheng did not answer his question," Griffin wrote in her decision.

"He deposed that he 'did not notice anything out of the ordinary.'"

Zheng learned in June 2018 that she had been the victim of fraud, and that scams of this type had been reported on in local media before she made her transaction, according to the decision.

She filed her lawsuit in August 2020, alleging that "the bank knew of this prevailing fraud at the time of the transaction" and had a duty to warn her about it.

THE DISMISSAL

The bank's application to dismiss the case was first heard by a master of the B.C. Supreme Court, who granted it.

When Zheng appealed, a chambers judge reviewed the master's decision and did not find grounds for overturning it, though he disagreed with the master's conclusion that a claim based on the bank having a duty to inform Zheng of the fraud was bound to fail.

It was possible, the chambers judge wrote, that the bank would have a duty to "at least make an inquiry with Ms. Zheng about the potential for fraud," if Zheng's allegation that the fraud was "prevailing" in major Canadian cities at the time was found to be accurate.

"I would suggest that much turns on the extent of what the bank knew, or ought to have known, about this particular scheme and how specific that information was," the chambers judge wrote, as quoted in Griffin's appeal decision.

Despite this, the chambers judge dismissed Zheng's initial appeal, upholding the outcome of the master's initial decision, because he found the exclusion clause would apply and "there was no reasonable prospect that Ms. Zheng could establish her loss was solely caused by the bank’s negligence or wilful misconduct," Griffin summarized.

THE APPEAL

This line of reasoning is where the appeal judges disagreed with the chambers judge. While they accepted that the exclusion clause would defeat Zheng's claim if it applied, they disagreed with the chambers judge's finding that it must apply.

"The judge failed to consider that … Ms. Zheng has an available argument at trial that the bank’s error arose before the processing of the transfer instructions and therefore outside of the context and application of the exclusion clause," Griffin wrote.

If the bank had a duty to warn Zheng about the possibility of fraud, that duty could have come into play as soon as she inquired about making such a large transfer, before the bank asked her to sign the exclusion clause, the appeal judges concluded.

"I see the application and interpretation of the exclusion clause in this case as depending on the facts of the bank’s knowledge of the prevailing fraud and its duty to warn Ms. Zheng before it asked her to provide a signed application for remittance," Griffin wrote. "Since there is a genuine issue for trial about those facts, the judge ought not to have interpreted the exclusion clause as barring the claim."

Accordingly, the appeal judges allowed Zheng's appeal, set aside the chambers judge's order, and substituted an order that the bank's application to dismiss the case be, itself, dismissed.

CTVNews.ca Top Stories

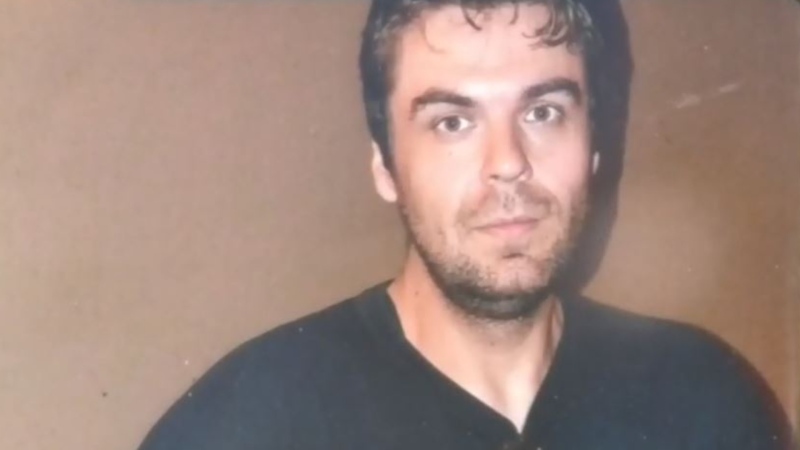

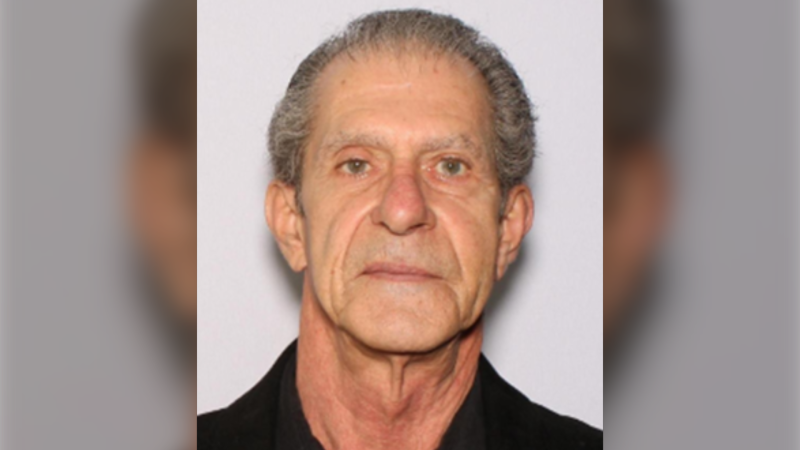

Widow looking for answers after Quebec man dies in Texas Ironman competition

The widow of a Quebec man who died competing in an Ironman competition is looking for answers.

Amid concerns over 'collateral damage' Trudeau, Freeland defend capital gains tax change

Facing pushback from physicians and businesspeople over the coming increase to the capital gains inclusion rate, Prime Minister Justin Trudeau and his deputy Chrystia Freeland are standing by their plan to target Canada's highest earners.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

U.S. Senate overwhelmingly passes aid for Ukraine, Israel and Taiwan with big bipartisan vote

The U.S. Senate has passed US$95 billion in war aid to Ukraine, Israel and Taiwan, sending the legislation to President Joe Biden after months of delays and contentious debate over how involved the United States should be in foreign wars.

Wildfire southwest of Peace River spurs evacuation order

People living near a wildfire burning about 15 kilometres southwest of Peace River are being told to evacuate their homes.

World seeing near breakdown of international law amid wars in Gaza and Ukraine, Amnesty says

The world is seeing a near breakdown of international law amid flagrant rule-breaking in Gaza and Ukraine, multiplying armed conflicts, the rise of authoritarianism and huge rights violations in Sudan, Ethiopia and Myanmar, Amnesty International warned Wednesday as it published its annual report.

Train derailed in Sarnia after colliding with a truck

Police are investigating after a transport truck collided with a train in Sarnia.

Fewer medical students going into family medicine contributing to doctor shortage

As some family doctors are retiring and others are moving away from family medicine, there are fewer medical students to take their place.

'It's discriminatory': Individuals refused entry to Ontario legislature for wearing keffiyeh

Individuals being barred from entering Ontario’s legislature while wearing a keffiyeh say the garment is part of their cultural identity— and the only ones making it political are the politicians banning it.