Economists from two Metro Vancouver universities are calling for a 1.5 per cent tax on vacant homes to help combat the region's growing issue of unaffordable housing.

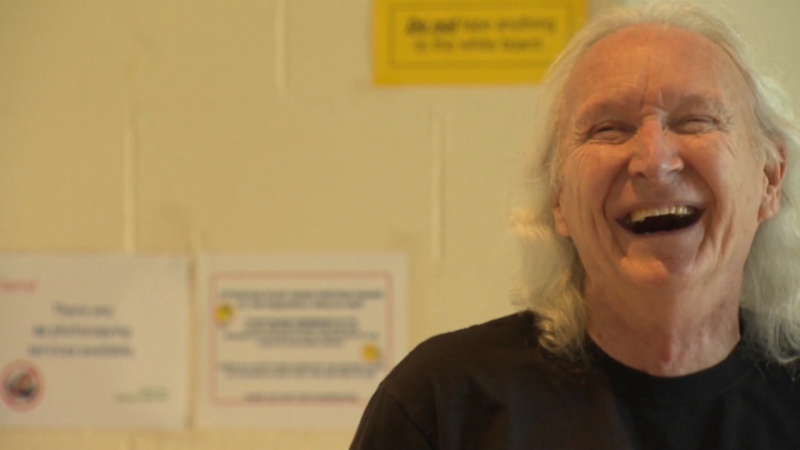

Tom Davidoff from the University of British Columbia's Sauder School of Business is among the economists pushing to ding investors who either leave their homes empty, or spend some time there but don’t pay Canadian income taxes.

The group estimates the measure would generate about $90 million annually in Vancouver alone – money that could be funneled directly back into the pockets of local taxpayers.

“People are struggling to pay for housing in and around Vancouver,” Davidoff said. “So what we’re proposing is the government writes them a cheque.”

That cheque would be paid for by people who park cash in the region’s real estate market, an issue some fear is pushing up housing prices and helping make ownership out-of-reach for locals.

Davidoff and his group, which also includes economists from Simon Fraser University, hope the tax would make properties less attractive to those kinds of investors – or at least encourage owners to open up their homes to renters, adding more units to the market.

Anyone who rents out their properties would be exempt from the 1.5 per cent tax, Davidoff said, as would other groups such as seniors and longtime residents.

Asked about the proposal on Monday, B.C. Premier Christy Clark said it’s a good concept that could be tough to implement.

“A university professor goes away for a year on a sabbatical at the University of Beijing, should we tax them?” Clark asked.

“Those are the kinds of complexities that we need to try and capture and then think about how we would identify who’s who. Other places that have done it in the past have had a lot of problems.”

Davidoff argued the tax would actually be easy and cheap for the government to implement, should it be pursued by cities and allowed by the province.

His group imagined a scenario where every homeowner is mailed a bill, then given a chance to explain why they should be exempt.

“Send homeowners a letter that says here’s your property tax assessment – easy information – multiplied by 1.5 per cent – easy number – here’s your bill. Now here’s some boxes for you to check to tell us why you don’t owe it,” Davidoff said.

The government could verify whether homeowners are telling the truth by simply cross-referencing data from the Canada Revenue Agency, he added.

Clark said she can’t guarantee the BC Liberals will implement the plan, but said it’s a “really good idea” that they will be looking into.

In the meantime, the premier promised her government is ready to start tackling housing affordability, and that there will be measures to support homebuyers getting into the market in the province’s upcoming budget.

Davidoff said that’s the wrong approach.

“A handout to people who can already afford houses that pushes up prices is not a serious solution to housing affordability,” he said. “A joke would be a kind way to put it.”

To learn more about the economists' proposal, click here.

With a report from CTV Vancouver’s Scott Roberts