British Columbia's finance minister is trying to put the brakes on demands his government push ahead on debate over the future of the harmonized sales tax.

Colin Hansen said Monday a legislative committee needs time look at the petition to abolish the HST before deciding what to do.

"What we have is a petition that had valid signatures of about 18 per cent of registered voters in the province," said Hansen. "What that triggers is the work of the committee. That's what we all have to expect will be respected."

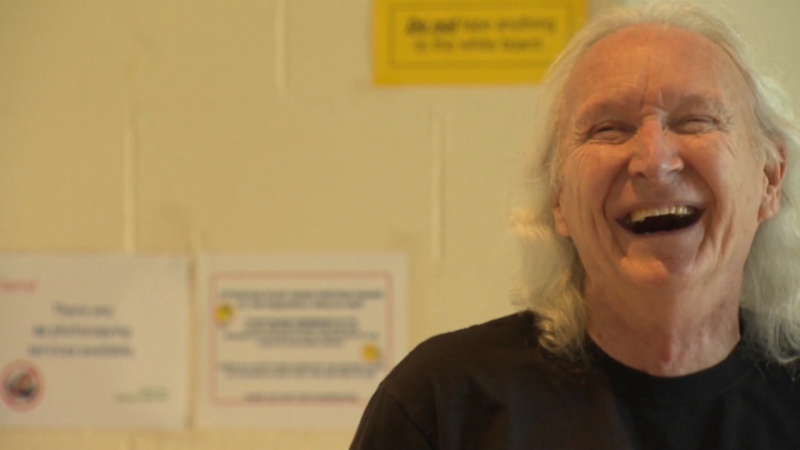

But former premier Bill Vander Zalm, who led the fight against the harmonized tax, wants the Liberal government to hold a free vote on getting rid of the tax this fall.

Vander Zalm's team managed to get 700,000 people to sign a petition aimed at scrapping the tax.

Elections BC said Monday it disqualified about 150,000 of those signatures, but even with the lower number, the petition still passed the threshold needed to force a legislative committee to look at the matter.

The committee has two options: send the proposal to scrap the tax to a vote in the legislature or order a non-binding, province-wide referendum a year from now.

The committee received the petition Monday and, under the law, it must hold its first meeting within a month.

Vander Zalm said holding a referendum would be "costly and undemocratic."

"A non-binding initiative vote is a waste of time and money, since even if it passes, the bill will only come right back to the legislature for a vote anyway."

But Terry Lake, the Liberal chairman of a committee that has never met before, said he won't be rushed.

"The unknown stems from the fact this committee has never had to do any work before," he said. "This is the first initiative petition the committee has dealt with. We're in uncharted territory in terms of what to expect. I don't want to predict the outcome."

Both Ontario and British Columbia merged the federal GST and the provincial sales tax July 1, at the same time that Nova Scotia increased its harmonized tax by two per cent.

Statistics Canada said the HST accounted for 1.2 per cent of British Columbia's two per cent increase in inflation and 0.8 per cent of Nova Scotia's 1.7 per cent increase, but cautioned that the figures are "upper-bound estimates."

Consumer prices in Ontario rose 2.9 per cent in July -- the largest year-over-year hike among the provinces, Statistics Canada found.

The agency concluded the HST accounted for about 1.3 per cent of that increase in Ontario.

Ontario and B.C.'s most recent inflation figures "may seem alarming," but inflationary pressures will gradually subside over the next year, TD economist Shahrzad Fard wrote in a note Friday.

When Ontario and B.C. moved to the HST, producers faced a slightly higher cost of production and that trickled down to consumers who paid more for goods and services, she said in a recent interview.