The much-maligned Harmonized Sales Tax bids B.C. adieu this Monday, but only about 75 per cent of businesses have registered to collect the returning Provincial Sales Tax, a government spokeswoman says.

While roughly 75,000 businesses updated their point of sale systems to be PST-compliant by the end of the weekend, about 25,000 haven’t lifted a finger, said small business minister Naomi Yamamoto.

“I kind of figured this might happen because as a small business owner, the last kind of thing you want to do is this type of work,” she said.

What does that mean for customers who purchase from one of those businesses?

“The consumer should probably look at their receipt and ensure that they’ve been charged the PST and the GST,” Yamamoto said. “In most cases, there won’t be any issue.”

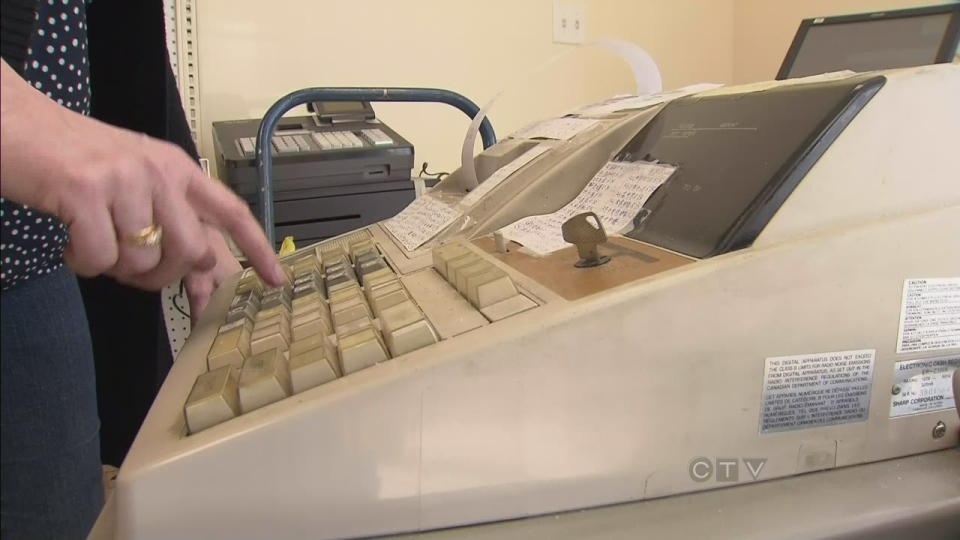

Meanwhile, cash register programmers were in high demand heading into Easter long weekend.

Tish Gladwin of Pacific Cash Register said the company opened its doors on Good Friday, though it was meant to be closed.

She said businesses owners have been in good spirits despite the additional paperwork and costs associated with switching back to PST.

“Everybody who’s come in here has been absolutely fantastic,” she said “No one’s complained, there’s not even a complaint about the cost of it.”

Gladwin said returning to the familiar PST still has its drawbacks, particularly for businesses that opened after the HST was introduced.

“There’s a lot of businesses that have started in the last two years, and there’s a lot of small businesses that haven’t got a clue about the taxable status of PST, and they’ve gotta teach their staff,” she said.

The B.C. government said it will allow businesses time to make the transition, and also urged consumers to examine their receipts closely come Monday.

Businesses can register to collect PST through the B.C. government’s website here.

With a report from CTV British Columbia’s Lisa Rossington