New research shows too few people plan for retirement. They don't save enough, and many end up having to retire earlier than they planned either because of health issues or being forced out of a job.

It’s a grim picture that could act as a wake-up call for many Canadians in the workforce.

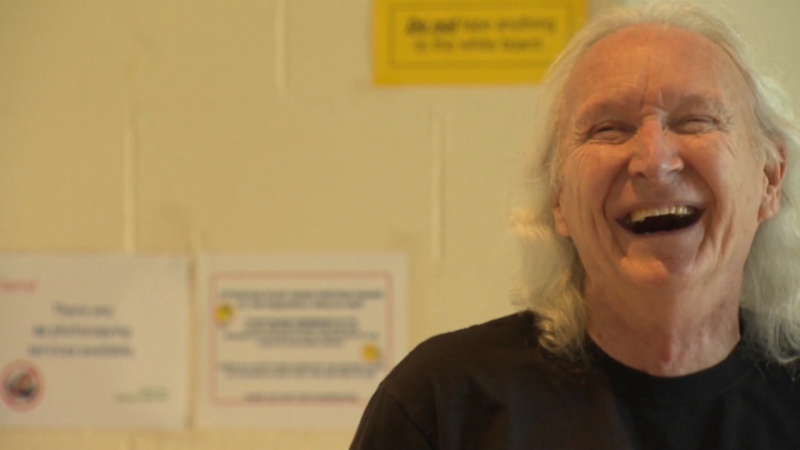

Louise Leclair, 69, and Stuart Alcock, 72, are among the lucky ones. They have pensions to fall back on as well as some savings.

Alcock says if he didn’t have his pensions, he would be in bad financial shape.

“I’d be poor, like half the seniors in this province are poor,” he told CTV’s Ross McLaughlin.

According to the Office of the Seniors Advocate, the median income for retirees in B.C. is $26,000 a year. Leclair says she has friends who are still working in their 70's.

A recent survey by Insights West and Credential Financial has found the majority of Canadians are not prepared for retirement.

- 68 per cent don’t have a retirement plan

- 30 per cent haven’t saved a cent

- 62 per cent ended up retiring earlier than expected

So how do you prepare to leave the workforce?

"You need sort of an arm's length person that can truly ask you questions that maybe you haven't thought of or maybe you haven't honestly answered," said Kim Thompson, senior vice president at Credential Financial.

Those questions may include– what are your real debts and how much debt should you carry into retirement? Do you have aging parents who will need your help? Where will you live? Do you have a partner or will you plan to be on your own? And there are many other issues you may not have considered. Your needs in retirement may be very different than how you live today.

Thompson believes a financial advisor can help. The survey also showed nearly a third entered retirement with more debt than anticipated.

So what can you do? Reduce expenses where you can, save early and save a lot, take advantage of company pension plans, and take advantage of tax free or tax deferred savings.

For example if you're 20 years old and start putting away $200 every month until you're 65 with an investment return of six per cent, you'd have $510,584.

If you waited until 45 years old to start saving you'd have to save about $1,150 a month to get to there.

In today's workforce many companies no longer offer pensions, younger workers are hired as contract workers and move around which is why it is totally up to you to look after your own retirement. Canada Pension and Old Age Security may not be enough to cover you when the time comes.

Reporters note: In my effort to make the point that we need to take control of our own future and not depend on the government to take care of us, I overstated in my on camera comments about the Canada Pension Plan likely not being there in the future. However, I quickly tried to correct myself stating, "Or likely won't be enough." My point was that we can't necessarily rely on future governments to maintain status quo and need plan our retirement. However, I should have been more emphatic in correcting that statement about CPP. A couple of folks have pointed out that the Canada Pension Plan is fully funded to last 75 years. Click here to see the Chief Actuary Report from the Canada Pension Plan Investment Board.