Would you put money into a slot machine or gamble at the blackjack table if the house never paid out?

Many Canadians are falling victim to online trading sites which offer binary option trading. That’s when you bet on a stock or asset to go up or down, sometimes within minutes or even seconds.

It’s an all or nothing bet. Get it right – you get a predetermined payout. Get it wrong – you lose everything.

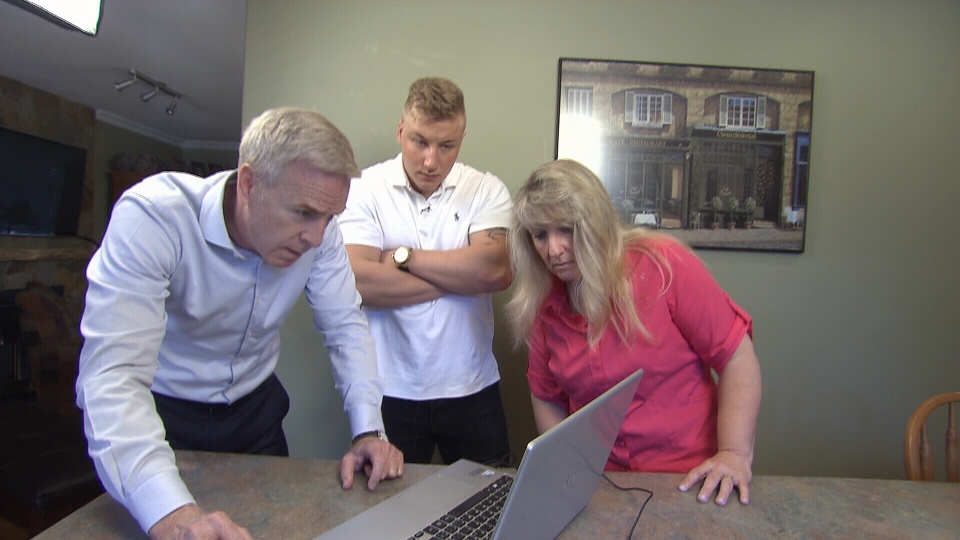

And even if it looks like you’re winning, good luck when comes time to collect. Spencer Meyer, a 21-year-old from Surrey, knows how difficult it can be.

“Very easy to get your money in, not so easy to get your money out,” he told CTV News.

He invested about $2,200 in binary option trading on a website called OptionRally and says he was up $27,000. He did get a small payout but then couldn’t collect the rest.

“I saw a thousand dollars of that,” he said.

That was the hook. While he was winning he got his mom, Shelley Spencer, involved too. She put up $16,000.

What they didn’t know is the site wasn’t registered to do business in Canada. The director of enforcement at B.C.’s Securities Commission, Doug Muir, says unfortunately people realize their mistake too late.

“There’s no company in British Columbia or Canada that is authorized to sell binary options,” he said.

And he pointed out that many of the offshore websites are nothing more than fronts and no actual trading ever takes place.

“There’s these teaser results where you may get up early on and that entices you to invest more money. And as you invest more money, that’s the money you don’t get back and that’s how we have some of these catastrophic losses. People losing a lot of money,” Muir said.

“They [staff at OptionRally] would call me: 'Oh, why are you taking out the money Spencer? Why are you taking out the money?'” Meyer said. But when Spencer and his mom caught on, the calls stopped completely.

“Then you do look at yourself as gullible,” Shelley Spencer said.

But many have followed the same path. An effort is now underway to ban binary option trading in Canada.

And a website has been established to warn consumers.

Shelley Spencer was fortunate that her credit card company reversed the charges. However, her son Spencer learned an expensive lesson because he transferred money directly from his account.

“Don’t put your money into a computer unless you know who’s behind it,” he said.

Find out if an individual or company is licensed to sell securities in Canada by clicking here.