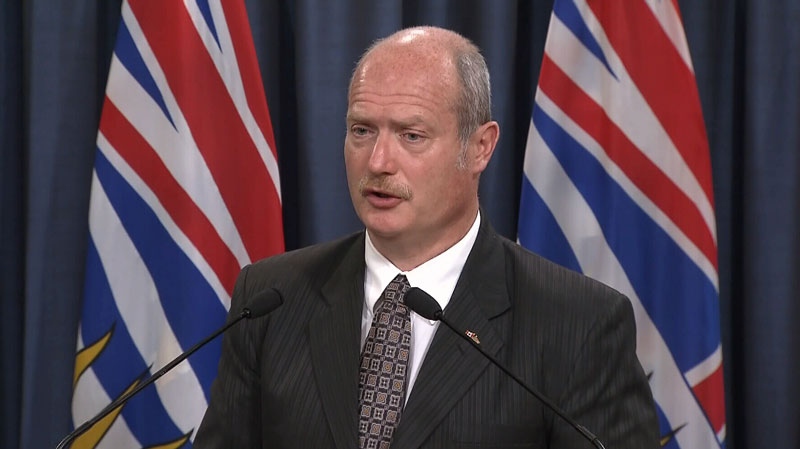

VICTORIA -- British Columbia's projected budget surplus numbers are rising, but the Liberal government isn't planning a spending spree, Finance Minister Mike de Jong said Wednesday.

He said the latest financial figures reflecting the first six months of the fiscal year point to a projected budget surplus of $444 million. The government forecast a surplus of $184 million when the budget was tabled last February.

De Jong said the projected surplus leaves room to consider funding more programs, but he warned there are debts to be paid for money borrowed for existing programs.

Earlier this month, the all-party Finance and Government Services Committee endorsed the government's commitment to balanced budgets, but among its 58 pre-budget recommendations were calls to review poverty-fighting programs.

The committee mentioned social assistance rates, the minimum wage and a child-support clawback program that has drawn protests at the legislature and is the focus of a consultation process set to start next month. The committee also recommended that the government consider increasing payments to people with disabilities to reflect higher costs of living.

"One of the ways governments all over the world get into trouble is that when times get tough they are quick to run to the banks to borrow money and never get around to paying it back," de Jong said. "Every family in B.C. understands it is legitimate to seek financing through difficult times, but you've got to pay it back."

Opposition New Democrat finance critic Carole James said the government should consider using the surplus to ease the burdens faced by many British Columbians. She said much of the government's revenue comes in the form of increased taxes, fees and rates, including medical service premiums, hydro rates and charges from the Insurance Corp. of B.C.

"It's really important to remember the increase in surplus comes from British Columbians," she said. "It's there because the government has taken money from the pockets of British Columbians."

James said removing the clawback of child-support payments would cost the government $17 million.

De Jong said the report includes a revenue forecast of $45.5 billion, which is $194 million more than projected in September. He added that the increases come from more property transfer tax, federal transfers and commercial Crown corporation revenues.

The transfer tax revenue is up $100 million, thanks to a booming housing market. Housing starts and retail sales are both up by almost six per cent, and there have been major increases in vehicle sales.

But revenues from natural resources, including forests and minerals, are down. Forests revenues dropped $31 million because of smaller harvests and lower stumpage rates.

De Jong said the provincial debt is projected to be more than $1 billion lower than the original forecast of $64.7 billion.

Economic growth forecasts of 1.9 per cent this year and 2.3 per cent in 2015 have not changed since the first quarterly report in September.

De Jong is to meet with the Economic Forecast Council to discuss B.C.'s economic outlook on Dec. 5 in Vancouver.